January 8, 2026

Happy New Year!

With the holidays behind us, it's time to summarize last year's activities and prepare to file your 2025 tax return. So as you wait to receive the needed documentation, why not consider squeezing in a tax-savings New Year's resolution? This month's newsletter outlines three to consider.

You’ll also find guidance on staying organized to prepare for filing your 2025 tax return. This is even more important with recent tax law changes including the tax-free tips and tax-free overtime benefits. There are also articles outlining practical money ideas anyone can use plus a look at technology changes that are beginning to show up in everyday life.

As always, should you have any questions, please call. And feel free to forward this information to someone who could use it!

IN THIS ISSUE

- Happy New Year...Consider These Tax Resolution Ideas

- It's Tax Time! Ideas to Get Organized

- Five Great Money Tips

- Raising a Financially Savvy Child

- Improving the Usefulness of Your Bookkeeping

Happy New Year...Consider These Tax Resolution Ideas

Every January brings a familiar ritual. We promise to eat better, exercise more, and finally organize the garage. These are fine goals, but if you want a resolution that delivers real, measurable value, fewer taxes paid over your lifetime is about as concrete as it gets. Here are three possible resolutions to consider:

Resolution #1: Maximize use of your retirement accounts

One of the simplest ways to lower your current tax bill is by maximizing contributions to 401(k)s, IRAs and similar accounts. You can also defer taxes by maximizing contributions into 401(k)s and Traditional IRAs or reduce your taxes in the future by considering Roth accounts.

Some other great tips:

- Ensure you are taking advantage of catch-up contributions.

- Always contribute to take advantage of any employer matching programs.

- Take full advantage of SEP IRAs as a small business owner.

- Look to create additional accounts when possible through spousal retirement accounts or youth accounts when children have earned income.

This resolution can be rich with tax saving ideas.

Resolution #2: I will keep my tax records organized.

If tax season feels like a scavenger hunt through old emails and crumpled receipts, organization should be high on your list. Remember, if you can't support a deduction, you can't take it. This is especially true if you run a small business, if you want to take advantage of things like the new $1,000 ($2,000 joint) charitable contribution deduction, or claim the teacher out-of-pocket expense deduction. The same is true with educational expenses.

Resolution #3: Commit to paying health costs tax efficiently

A health savings account (HSA) is one of the most powerful tax saving tools in the tax code. Contributions are often deductible, with earnings on funds in the account usually tax-free. Plus qualified medical withdrawals are also tax-free. So try to maximize your eligible donation into your HSA each year, including catch-up contributions. Then invest your unused funds to grow tax-free. Leaving the HSA untouched allows it to function like a stealth retirement account. Years down the road, those funds can be used for healthcare costs that almost everyone faces, often with significant tax advantages.

Making taxes a year-round conversation

Taxes are not a once-a-year event. Life changes like income shifts, business activity, investments, or family milestones can all affect your strategy.

This year, choose a resolution that quietly compounds, rewards consistency, and pays you back every April.

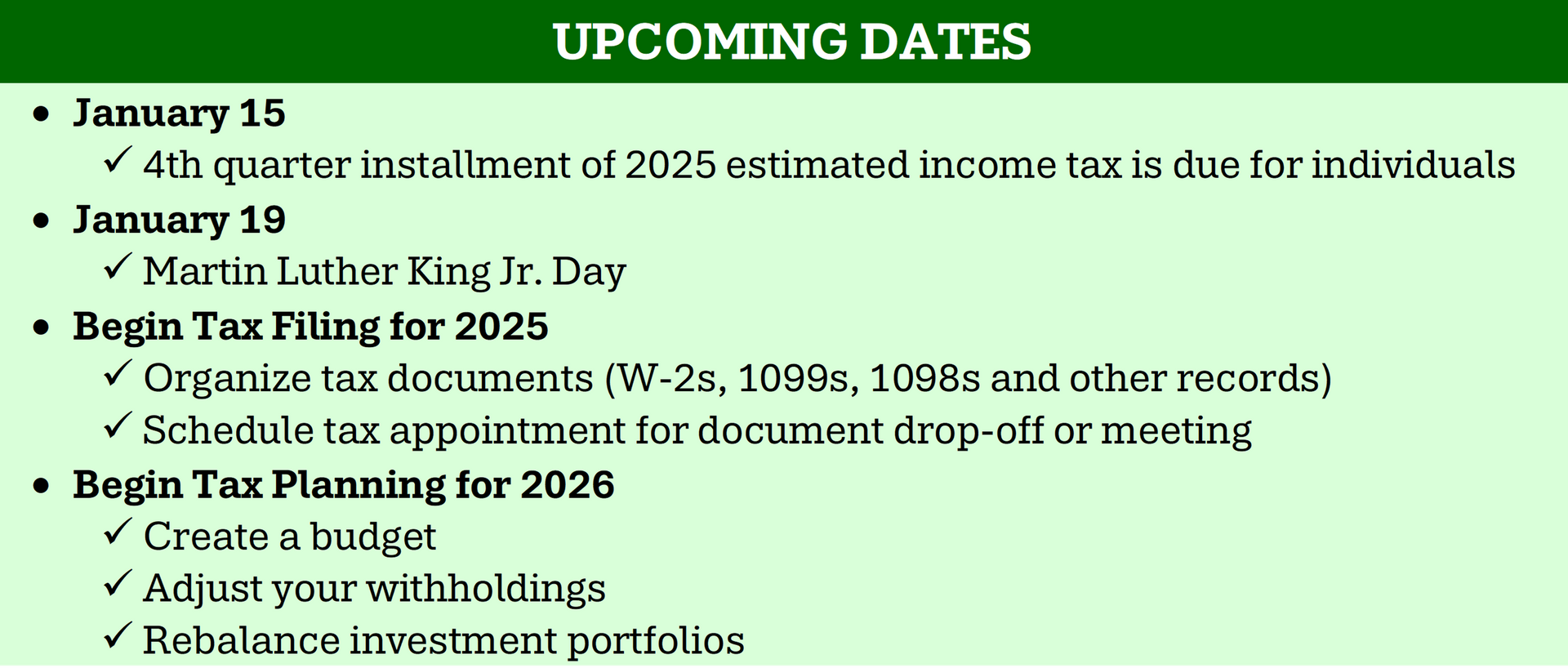

It's Tax Time! Ideas to get Organized

With tax season officially underway, here are several ideas to make filing your return as stress-free as possible:

Gather your tax information for filing.

Items you'll need include K-1s, W-2s, 1099s and other forms you receive from your business, employers, brokers, banks, and others. If you find any errors, contact the issuer immediately to request a corrected copy. And if you have tip or overtime income, be prepared to break this income out to take advantage of tax-free savings as this will not necessarily be broken out on your W-2.

Organize your records.

Once you've started gathering your information, find a place in your house and put all the documents there as you receive them, or consider scanning documents to store on your computer. You can also take pictures of the documents with your phone as backup. Missing information is one of the biggest reasons filing a tax return becomes delayed.

Create an April 15th reminder.

This is the deadline for filing your 2025 individual income tax return, completing gift tax returns, making contributions to a Roth or traditional IRA for 2025, and for paying the first installment of 2026 individual estimated taxes.

Know the deadlines for business returns.

If you are a member in a partnership or a shareholder in an S corporation, the deadline for filing business returns for these two entities is March 16th. Calendar-year C corporation tax returns are due by April 15th.

Review your child's income.

Your child may be required to file a 2025 income tax return. A 2025 return is generally required if your child has earned more than $15,750, or has investment income such as dividends, interest, or capital gains that total more than $1,350.

Contribute to your IRA and HSA.

You can still make 2025 IRA and HSA contributions through either April 15th or when you file your tax return, whichever date is earlier. The maximum IRA contribution for 2025 is $7,000 ($8,000 if age 50 or older). The maximum HSA contribution is $4,300 for single taxpayers and $8,550 for families.

Calculate your estimated tax if you need to extend.

If you file an extension, you'll want to do a quick calculation to estimate your 2025 tax liability. If you owe Uncle Sam any money, you'll need to write a check by April 15th even if you do extend.

Five Great Money Tips

Creating a sound financial foundation for you and your family is a great goal. Here are five thoughts that may help.

Pay yourself first.

Treat saving money with the same care you pay your bills. Take a percentage of everything you earn and save it. Using this technique can help build your savings balance and keep you from living paycheck to paycheck.

Know and use the Rule of 72.

You can roughly calculate the number of years compound interest will take to double your money using the Rule of 72. Do this by dividing 72 by your rate of return to estimate how long it takes to double your money. For example, 10% interest will double an investment in 7.2 years; investments with an 8% return will double in nine years. Use this concept to understand the power of saving and investing.

Use savings versus debt for purchases.

Unpaid debt is like compound interest but in reverse. For instance, using a credit card with a 12% interest rate to pay $1,500 for home appliances costs over $2,000 if paid back over 5 years. The result is that you have to work harder and earn more to pay for the items you purchase. A better idea may be to save and then buy your dream item.

Understand amortization.

When a bank loans you money, it gives you a specific interest rate and a set number of years to pay it back. Each payment you make contains interest as well as a reduction of the amount owed, called principal. Most of the interest payments are front-loaded, while the last few payments are virtually all principal. Making additional principal payments at the beginning of the loan’s term will decrease the amount of interest you pay to the bank and help you pay off the loan more quickly.

Taxes are complex and require help.

Tax laws are complicated. They are made even more complex when the rules change, like this year!. Even worse, the IRS is not in the job of telling you when you forget to take a deduction. The best way to stay out of the IRS spotlight AND minimize your taxes is to ask for help.

Raising a Financially Savvy Child

If you have children or grandchildren, you have an opportunity to give them a jump-start on their journey to becoming financially responsible adults. While teaching your child about money and finances is easier when you start early, it's never too late to impart your wisdom.

Here are some age-relevant suggestions to help develop a financially savvy young adult:

Preschool

Start by using dollar bills and coins to teach them what the value of each is worth. Even if you don't get into the exact values, explain that a quarter is worth more than a dime and a dollar is worth more than a quarter. From there, explain that buying things at the store comes down to a choice based on how much money you have (you can't buy every toy you see!). Also, get them a piggy bank to start saving coins and small bills.

Grade school

Consider starting an allowance and developing a simple spending plan. Teach them how to read price tags and do comparison shopping. Open a savings account to replace the piggy bank and teach them about interest and the importance of regular saving. Have them participate in family financial discussions about major purchases, vacations and other simple money decisions.

Middle school

Start connecting work with earning money. Start with activities such as babysitting, mowing lawns or walking dogs. Open a checking account and transition the simple spending plan into a budget to save funds for larger purchases. If you have not already done so, now is a good time to introduce the importance of donating money to a charitable organization or church.

High school

Introduce the concept of net worth. Help them build their own by identifying their assets along with their current and potential liabilities. Work with them to get a part-time job to start building work experience, or to continue growing a business by marketing for more clients. Add additional expense responsibility by transferring direct accountability for things like gas, lunches and the cost of going out with friends. Introduce investing by explaining stocks, mutual funds, CDs, and IRAs. Talk about financial mistakes and how to deal with them when they happen by using some of your real-life examples. If college is the goal after high school, include them in the financial planning decisions. Tie each of these discussions into how it impacts their net worth.

College

Teach them about borrowing money and all its future implications. Explain how credit cards can be a good companion to a budget, but warn them about the dangers of mismanagement or not paying the bill in full each month. Discuss the importance of their credit score and how it affects future plans like renting or buying a house. Talk about retirement savings and the importance of building their retirement account.

Knowing about money – how to earn it, use it, invest it, and share it – is a valuable life skill. Simply talking with your children about its importance is often not enough. Find simple, age-specific ways to build their financial IQ. A financially savvy child will hopefully lead to a financially wise adult.

Improving the Usefulness of Your Bookkeeping

If you are just starting a business or have been in one for a while, you quickly understand the importance of keeping good records. And as a financial person, having an owner that understands the basics of great bookkeeping makes it so much easier to help that owner understand what those books are telling them.

So, on that front, presented here are four keystone bookkeeping concepts that are worthy of discussion:

Selecting the proper accounting method.

There are two different methods for recording transactions: cash-basis and accrual-basis. In general, the cash-basis method records a transaction when a payment is made or cash is received, while the accrual-basis method records the transaction upon delivery of the good or service, either as a sale or as cost. Small businesses often use cash-basis as it is easier to track. Larger businesses who buy from vendors on account (accounts payable) use accrual-basis accounting. The key is to understand what method your business uses and whether it uses the same method for your books as it does on your tax return. The IRS allows the cash basis method for tax purposes for most of the small businesses, but once a choice is made, it can only be changed with proper reporting to the IRS. Things to consider: How important is the matching principal to your business? This aligns revenue with related costs to get a clean picture of interim profitability. If this is important, accrual might be best. What about the importance of cash flow? If high, using cash basis will get you answers more quickly.

Create an account structure that fits the company.

The main types of accounts in a business are assets, liabilities, equity, income, cost of goods sold, and other expenses. Each group will often have numerous accounts and sub-accounts associated with them. Having the right mix of accounts, created and grouped in an organized fashion, will help you properly classify transactions and prepare usable financial statements. Things to consider: If there is little activity in an account, consider summarizing it with other like items. Know why you need an account before you create it...to make business decisions? to compare to last year? for tax reasons?

Enter accurate and timely transactions.

The value your data provides is dependent on each transaction being recorded correctly and on time. Entering transactions in the wrong account can cause significant issues down the road. Financial reporting that is delayed can hide problems that need immediate attention. Some transactions are straightforward, and some are more complex (like payroll, accruals, and deferrals).Things to consider: Conduct a flash report the first day of each month. This will get the ball rolling.

Establish financial statements for decision-making.

The purpose of your statements should be to help you run your business and make decisions. For the bank, it is to see if you are at a significant risk of lending money. To the government, it is to pay taxes. Or for the prospective buyer, to value your company's worth. Things to consider: Really understand the three key financial statements (income statement, balance sheet, and statement of cash flows). Know how they inter-relate and understand how to read them to make better decisions. What key accounts are the drivers of your business? What is the bank looking at?

If properly executed, your bookkeeping system will create accurate financial statements that can be used to make key financial decisions.

Feel free to call with any questions or to discuss bookkeeping solutions for your business.

As always, should you have any questions or concerns regarding your tax situation please feel free to call.